As property agents working in the wonderful historic city of Bath, we feel we must provide a comprehensive and realistic perspective on the market. Despite reports at the back end of 2022 that the market was expected to crash, the actual data reveals that the national and local markets are holding steady and have even continued to see substantial growth.

NATIONAL HOMES FOR SALE:

To better understand the current state of the market, we must look at the influx of new properties coming to the market. In the second quarter of 2024, 450,486 properties were listed for sale across the UK. This figure is higher than the 411,927 properties listed in Q2 of 2023, and the Q2 average of the last 7 years prior.

The average price of a UK property coming to market in Q2 of 2024 was £454,223. For comparison, the average price in Q2 of 2023 was £438,551.

NATIONAL SALES AND PRICE BANDS:

In Q2 of 2024, 308,969 properties were sold subject to contract (STC) in the UK. Much higher than the 269,989 properties sold STC in Q2 2023. This figure too is above the 7-year average of 299,324.

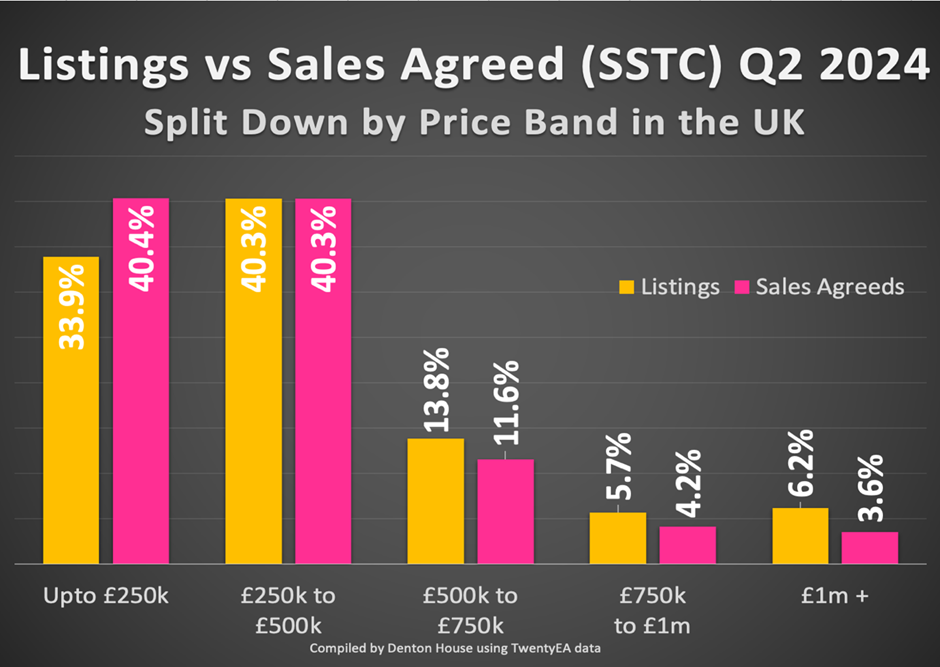

The average price of a UK property sold STC in Q2 204 was £369,373 compared to £367,030 in Q2 of 2023. Examining listings by band price also provides us further insight into the market:

- 33.9% of new listings were priced up to £250,000, yet this segment accounted for 40.4% of sales.

- 40.3% of new listings were in the £250,000 to £500,000 range, and 40.3% of sales were also in this price range.

- 13.8% of listings were priced between £500,000 and £750,000, yet only 11.6% of sales occurred in this band.

- 5.7% of listings were priced between £750,000 and £1m, yet only 4.2% of sales occurred in this band.

- 6.2% of listings were priced £1m +, yet only 3.6% of home sales occurred in this band.

The data highlights that there is stronger performance among the lower-priced properties, indicating that affordability is driving the market.

MARKET DYNAMICS AND PRICING STRATEGY:

Pricing realistically from the outset is essential in the current market. In Q2 2024, there were 225,745 price reductions on the 673,973 properties on the market. This indicates that initial realistic pricing needs to take place to avoid subsequent price cuts. Price cuts can sometimes be necessary, however, it is advisable to avoid these price cuts as they often indicate that there is an underlying issue with the property and can deter potential buyers.

Overall, despite the continued higher mortgage rates and economic uncertainties, the Bath property market has now surpassed the sales levels pre-pandemic. Despite this good news, sellers should still aim to price their properties competitively to attract buyers where there are more homes for sale.

BATH PROPERTY MARKET SPECIFICS:

Locally, in Bath (BA1/BA2), 995 properties were listed in Q2 2024 with an average asking price of £694,857. In this local market, the most active price bracket was the £400,000-£500,000 range with the highest number of new listings at 151 properties coming to the market.

Sales in Bath during the same period totalled 720 properties, with an average purchase price of £599,053. As expected, the same price bracket of £400,000-£500,000 was the most active with 122 sales agreed.

CONCLUSION:

Ultimately, any house move is and should be primarily based on personal circumstances rather than just purely market conditions alone. So, if you are contemplating a move, then be sure to get in touch with the team here!