The UK property market has undergone significant shifts since the summer of 2020. This has been driven primarily by the post-lockdown ‘rush to move’ after everyone who’d been stuck inside for 3 months felt they had ‘outgrown’ their homes and were further incentivised by the stamp-duty levy.

Following this rush to move, there have been significant interest rate hikes aimed at curbing inflation in 2022 & 2023. These changes have had far-reaching implications across the property market and have had a significant impact on both house prices and the overall volume of property transactions.

INTEREST RATE SURGE AND ITS IMPACT:

The initial wave of interest rate hikes began in November 2021, as the Bank of England (BoE) sought to counter the ever-rising inflation post-lockdown, and this continued until the summer of 2023.

There were 14 rises in interest rates during this period – the culmination of which was a peak rate of 5.25%. The Bank of England’s decision to implement such a rigorous monetary policy stemmed from concerns about the rapidly escalating cost of living (now dubbed the ‘cost of living crisis’), the consequence of both domestic and global pressures.

However, the tide began to turn this August as the BoE cut rates slightly to 5% in response to the improvement of the nation’s inflation rates. This reduction was coupled with signs that further cuts could be on the horizon, something that has brought about a sense of cautious optimism in the market. There is, for the first time in many months, a slight glimmer of hope that the worst of the economic fallout may be behind us.

HOW HAS THIS AFFECTED THE LOCAL PROPERTY MARKET HERE IN BATH?

Let us first look at the house prices locally between 2020 and 2024.

The average value of a property in Bath in July 2020 was £347,652. Today, that figure has risen to £432,528 – a rise of 24.42%, significant. So despite predictions that there would be a property market crash of sorts, there hasn’t been. So with prices not dropping, surely it is cash buyers that are keeping the property market afloat? Especially considering the hike in interest rates over the last 4 years.

CASH BUYERS: NOT THE GAME CHANGER WE EXPECTED:

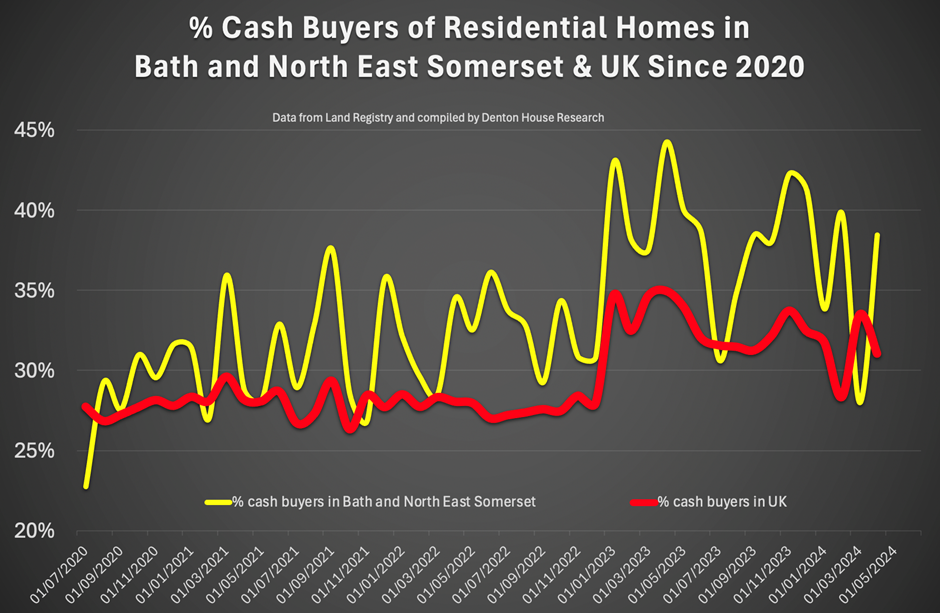

In analysing the performance of the different segments of the British property market during this tumultuous period, one of the more surprising findings is the limited role that cash buyers have played in keeping the Bath property market alive. Traditionally, cash buyers have been perceived as having a significant advantage in house buying when there are periods of high interest. This is due to the lack of financing needed which in turn allows them to be protected from the direct effects of higher borrowing costs. So in theory, this should allow them to dominate the market when mortgage rates soar. So, did the number of cash buyers rise when interest rates began to rise in 2022?

THE PROPORTION OF UK HOME BUYERS WITH CASH HAS INDEED RISEN FROM 20%+ IN 2020/21 TO 30%+ IN 2023/24:

So as the above statement says, there has indeed been an increase in cash buyers, but this has not been the expected avalanche. Despite significant financial advantages, cash buyers did not dramatically alter the market dynamics. Instead, the dictators of the pace of the market turned out to be those who were reliant on mortgages. So, even as the cost of borrowing increased, there continued to be many mortgage-backed buyers and the cash buyers didn’t dictate the market as expected. This trend truly underlines the critical role mortgage buyers play in shaping market conditions.

Locally here are the figures:

- In 2020, 27.57% of UK home buyers were cash buyers, whilst in Bath and North East Somerset, 28.6% of buyers were cash buyers.

- In 2021, 28.06% of UK home buyers were cash buyers, whilst in Bath and North East Somerset, 31.2% of buyers were cash buyers.

- In 2022, 27.79% of UK home buyers were cash buyers, whilst in Bath and North East Somerset, 32.1% of buyers were cash buyers.

- In 2023, 32.94% of UK home buyers were cash buyers, whilst in Bath and North East Somerset, 38.9% of buyers were cash buyers.

- In 2024 YTD, 31.15% of UK home buyers were cash buyers, whilst in Bath and North East Somerset, 35.0% of buyers were cash buyers.

Locally in Bath and Northeast Somerset, we also saw a growth in cash buyers – yet again, nothing groundbreaking!

MORTGAGE STRESS-TESTING AND MARKET STABILITY:

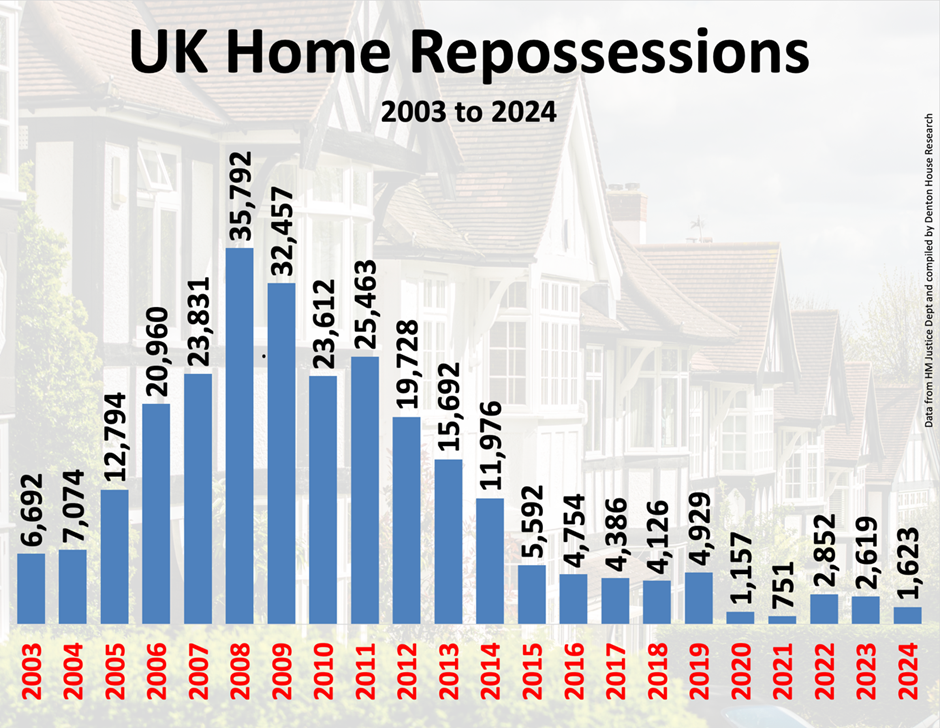

So, why were those who predicted a significant crash in the market so wrong, despite the increased mortgage rates? Well, mostly it was down to the effectiveness of the mortgage market review stress testing rules introduced in 2014 for borrowers after the global financial crisis of 2008. These rules, designed to ensure that borrowers could withstand higher interest rates, have been instrumental in maintaining stability in the property market. Even as mortgage rates more than quadrupled from their lows, over three quarters of UK’s local authorities saw house prices increase between the spring of 2022 and the spring of 2024.

This stability is further evidenced by the relatively low levels of repossessions compared to the aftermath of the 08/09 financial crisis. In the 4 years following the global market crash of 2008, 113,374 homes were repossessed in the UK. In the Covid years of 2020-2023, that number was 7,379.

Alongside this, strong wage growth (up from £31k a year to £35k) during this period and lender forbearance, have also played a pivotal role in supporting those who borrowed during the challenging period.

These factors collectively prevented the kind of widespread distress that many feared would occur as rates climbed.

AFFORDABILITY AND THE SHIFT IN BUYER PREFERENCES:

While house prices have held sturdy in most places, affordability has continued to be a significant concern for buyers, particularly in more expensive markets such as London. The term ‘race-for-space’ came about from the pandemic where buyers, held up in their smaller more confined homes in the big cities, sought to move further afield and gain more space for their money given many were working remotely and no longer needed to be held up in a commutable location. This rush in migration from urban areas to suburban or even rural areas has been a defining characteristic of the property market over the last few years. As rates have continued to rise, this trend has continued and even gained further momentum.

In the more expensive locations, where the cost of living and property prices were already high, the increase in mortgage rates has made buying a home even more challenging for many. As a result, these sorts of areas have seen a shift in the buyer demographic. Those less affected by higher rates—such as wealthier individuals or those moving from more affordable regions—continue to purchase, while others have been priced out.

SALES VOLUMES VS. PRICES: A COMPLEX RELATIONSHIP:

As we evaluate the performance of the UK housing market – it is evident that whilst prices have remained strong, the volume of sales has decreased in 2023 when compared to the surge that we witnessed in 2021.

Back in 2021, sales transactions peaked at approximately 1.4million, a significant increase when compared to the previous year. However, by the time 2023 rolled around, this figure had decreased to around 1.02million.

Despite the rise in interest rates during 2023, the transaction levels remained in line with long-term trends (1.06 million transactions on average per year between 2008 to 2019), highlighting the current resilience of the housing market. Current projections for the 2024 housing market are suggesting we may reach 1.15 million sales, indicating that the property market continues to be stable and aligns closely with historical norms.

The persistence of strong prices, despite lower volumes of transactions, suggests a degree of pent-up demand. If Bath buyers perceive that interest rates have stabilised or are beginning to decline, we could see a significant increase in transaction activity. This potential recovery is likely to be the most pronounced in regions where affordability remains a key factor, and where the desire for more space continues to drive buyer behaviour.

LOOKING AHEAD – A PIVOTAL MOMENT FOR THE BATH MARKET:

As we move forward, the property market in the UK looks to be held at a crucial juncture. The market is currently showing positive signs as we get to the latter end of 2024. Listings are up by 7.2% YTD compared to pre-pandemic levels and gross sales, 22% higher than the same time in 2023. Net sales have also been surging, a 28% increase compared to the same period from last year. Additionally, the 2.6% rise in sales price/sq.ft since January indicates a steady increase in demand.

Coupled with the recent rate cut and better-than-expected inflation figures, this may signal the beginning of a more stable period for the UK housing market. If the financial markets prediction of another cut by the end of the year to interest rates, then we may see renewed confidence among buyers.

However, it’s essential to recognise that the landscape has changed. The experience of the past four years has reinforced the importance of affordability, the resilience of stress-tested borrowers, and the critical role of mortgage buyers in setting market dynamics. As estate agents, understanding these shifts is crucial in navigating the evolving market and advising clients effectively.

As a Bath homeowner looking to sell, it’s crucial to approach the market with a realistic mindset. With only 53% of properties that come onto the market successfully reaching a completed house sale and move, the odds of selling can feel like a flip of a coin, (12 months to 23rd August 2024, of the 1,420,486 homes that left UK estate agents books, 798,886 homes exchanged and completed, and 710,620 homes withdrew unsold).

To ensure you’re on the right side of that coin, it’s vital to set a competitive price and present your property in the best possible light as this can significantly increase your chances of securing a sale and achieving your moving goals.

In Bath and similar towns and cities, where affordability and the search for space are particularly relevant, the insights gained from this period of upheaval will be invaluable. By staying attuned to these trends and anticipating the needs of our Bath clients, we can offer informed guidance in a time of change.

In conclusion, while the past four years have been challenging for the Bath and UK property market, they have also demonstrated its underlying strength and adaptability. As we potentially enter a more stable period, there is cause for cautious optimism. By understanding the factors that have shaped recent performance, we can better navigate the road ahead and continue to support our clients through whatever challenges and opportunities the future may hold.

If you would like to discuss anything about the Bath property market, please do not hesitate to call us at the office.