Across the UK the property market has met significant challenges over the past 18 months and yet in its wake has displayed a strong resilience to its forces. Many analysts predicted back in the autumn of 2022 that the country would see a dramatic downturn in house prices driven by economic uncertainty, cost of living crisis, and ever-increasing mortgage rates.

However, contrary to the dire forecasts predicted many months ago, the prices of houses across the country have remained relatively stable. This article will dive into the reasons behind this unforeseen occurrence and provide valuable insight for both homeowners and landlords alike.

ECONOMIC PREDICTION VS REALITY:

Liz Truss vs the lettuce…who remembers that? Well during her time in office, she and the treasurer at the time, Kwasi Kwarteng, produced their highly controversial ‘mini-budget’. Following this, there were widespread predictions that there would be a dramatic fall in house prices and some forecasts even predicted that we would see a decline of 20-35%. Yet, these never materialised. The decrease has been instead modest, with land registry figures showing about a 3.12% decline over the previous 18 months.

If we look at the past 12 months, British house prices have increased a measly 0.89%, when compared to this time in 2023. So, why were the forecasts so inaccurate?

IMPROVED LENDING PRACTICES:

During previous economic downturns, people have often cited banks’ poor lending standards. However, changes to mortgage regulations require banks to ensure borrowers can afford their monthly repayments, even if rates increase significantly.

This precaution has provided a substantial buffer for homeowners, enabling them to cope with the rising rates.

For example, in 2007 shortly before the global financial crisis, many borrowers did not need to prove their income to their banks. The 2014 MMR changes addressed this issue, ensuring that lending was based on sound financial footing. Consequently, many homeowners could still afford their mortgage when rates increased recently.

EMPLOYMENT & WAGE GROWTH:

Another crucial element has been the relatively stable employment situation. Although the UK experienced a brief recession over the winter, unemployment rates have remained low at 4.3%. For comparison, the unemployment rate during the 08/09 financial crisis was at 8.5%. Moreover, the average wages (inc. bonuses) have increased by 5.7% over the past year, reaching their record high at an average of £682 a week.

The combination of low unemployment and increased wage rates has led to fewer homeowners being forced to sell their homes due to financial difficulties. Banks have also been proactive and provided those with financial difficulties solutions to these problems with interest-only payments and extended mortgage terms to help them manage their repayments.

SUPPLY AND DEMAND DYNAMICS:

The impact of economic challenges on the property market has been more evident in transaction volumes than in prices. Typically, there are about 1.16 million house sale completions annually in the UK. However, during the ‘race for space’ seen at the back end of the COVID lockdowns, this number surged to 1.48 million. It then dropped back down to 1.26 million in 2022 and further to 1.02 million in 2023.

So, while demand has decreased because of higher mortgage costs, supply has also been reduced because of potential sellers choosing to wait for better market conditions.

On a final note, on this subject. There was in fact an increase in net house sales in the first 5 months of this year when compared to house sales in the first 5 months of 2023. However, there was only a 9.9% rise in new homes coming to the market.

FIRST-TIME BUYERS AND THE RENTAL MARKET:

Arguably the ones affected by the rising mortgage rates the most are first-time buyers. Typically, this is due to the larger amount they have to borrow in proportion to the home value. Despite this, they have been more active in the market than expected. This has likely been influenced by the rapidly rising rental costs. This rent increase has motivated many to purchase homes, often with financial help from families.

On that subject, data from the English Housing Survey revealed that 11 out of 30 first-time buyers received financial gifts from their families in the past year, up from 8 out of 30 in 2022. This support has played a vital role in the continued activity in the housing market.

THE BATH PROPERTY MARKET:

So, locally, how is this all affecting the market?

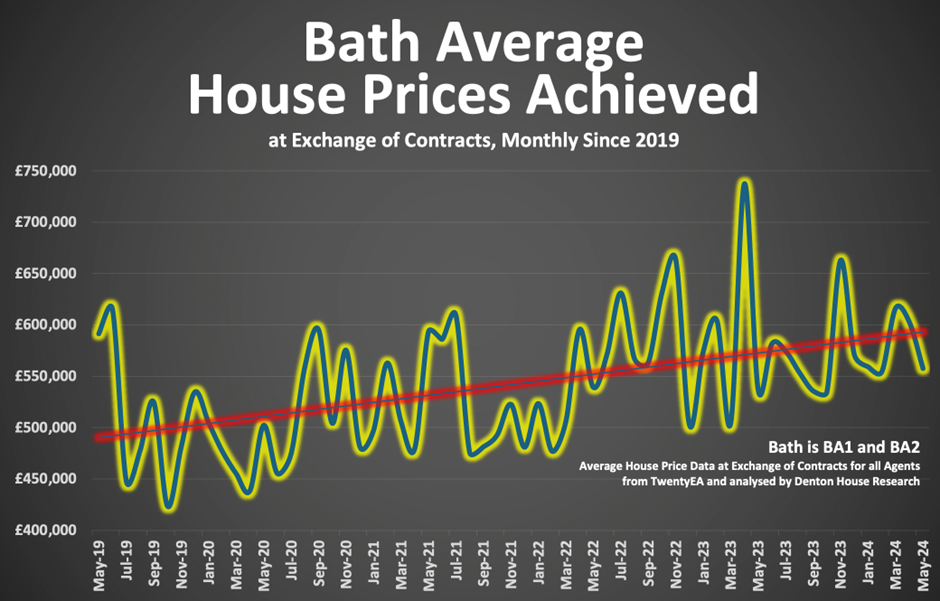

Looking at the monthly exchange of contracts data, the average price paid from may 2019 to April 2020 for a home in Bath (BA1/2) was £497,595.

In comparison, the average price paid between June 2023 and May 2024 has been £575,385. This is a rise in prices of 15.6%.

Now, it is important to stress that Bath home prices have not risen by 15.6%, only the average price paid between the two 12-month periods.

OUTLOOK FOR HOUSE PRICES:

Eighteen months ago, economists almost unanimously predicted a decline in house prices. Now, many forecasters are predicting growth. Estimates vary. Some are predicting an increase of around 4%, while others are suggesting a lower 3% rise. However, stretched affordability is also leading some to predict a flat market over the coming months.

What we can take away is the resilience and impressive ability to weather economic storms in the UK market. Partly thanks to sound lending practices, but also due to stable employment levels, rising wages and family support. While the volumes of sales have decreased from the hefty days seen in 2021, house prices have remained more stable than many predicted.

If there is concern about how the upcoming election may affect the market then do not fret. It is our belief that it will hardly have any effect on the medium-term direction of the property market (On the assumption none of the parties have any creative ‘wacky’ plans in their policies which are not yet published at the time of writing.)

So, as we enter the second half of the year, the property markets resilience will continue to be tested, but foundations laid over recent years are providing a solid structure for the navigation of any future challenges.